One of the largest servicers of student loans in the United States makes it easy for you to track your loans, schedule payments, apply for forbearance, and so much more. Navient understands customer service and is always quick to offer solutions to difficult situations. In the following article, we will show you how to create your very own Navient login so you may take advantage of all the services it offers online.

The internet has made everyone's lives a lot easier, and that is because you now have access to services that would otherwise have required your presence at a location. Navient takes full advantage of its online services and provides its debtors with a multitude of options for managing their loans. Having your own Navient login can help you keep your finances in order and will make the repayment process a lot easier for you. Navient's staff is available Monday - Thursday, 8 am to 9 pm, and Fridays from 8 am to 8 pm.

Navient Company Information

Navient is based out of Wilmington, DE, and services over $300 billion in student loans. Navient services loans for over 12 million customers and has been in business since 1973. As one of the largest servicers of student loans in the country, Navient continues to improve the way it handles and collects loans from its customers. Offering a multitude of services that make repayment easier for its customers, Navient stays on top of the game. Navient is the standard in student loan servicing and taking advantage of the perks offered online is advisable.

History

Navient, which was formerly known as the Student Loan Marketing Association, or Sallie Mae, is a government-sponsored enterprise that was established several years after the Higher Education Act of 1965 took effect. The U.S. Department of Education has Navient service all federal loans on its behalf and today the company not only trades stocks but also holds one of the largest portfolios of private student loans in the country.

Sallie Mae

Sallie Mae is likely the name that most people recognize Navient as. In 2013, Sallie Mae split into two separate companies, one which would continue to handle student loans, which is Navient, and another which is a Sallie Mae branch of consumer banking business. Despite the name change, Navient kept all the services it provided as Sallie Mae and even added a few over the years. The company today employs over 6,000 people and continues to be a force in the financial services industry.

Federal Ties

Navient services federal loans of students but also handles different federal loans for businesses and clients. Navient offers asset management options and business processing solutions. Navient has grown in a short amount of time into one of the most trusted and dedicated financial institutions in the country. Navient continues to provide their services to millions of students around the world.

Navient Services

Taking full advantage of the benefits of technology, Navient provides an online portal for its customers that grants access to repayment options, consolidation opportunities, and even loan forgiveness and discharge. Navient's services require you have a Navient login that is easy to get and costs nothing. There is no need to feel stressed out or overwhelmed as Navient can help you figure out your best course of action.

Income-Based Repayment Plan

One of Navient's most used services is its Income-Based Repayment Plan for federal student loans. Income-driven repayment plans are popular because they can help take the load off of students who are struggling to make payments after school. Income-driven plans consider your current income, whether you are single or married and/or have children and how many. Using this information, Navient helps you develop a repayment plan that takes only a percentage of your income - something manageable for you. The opportunity to apply for this benefit is offered with your Navient login.

Direct Consolidation

Direct consolidation is yet another form of repayment that takes all your current federal loans and merges them into one loan. This newly merged loan has a reduced interest rate and can fall under the Income-Driven Repayment plan. By merging your loans you can avoid the headache of keeping track of them and also of their different interest rates, and you can have your one and only loan in a single place. This plan is also offered under your Navient login and can save you a lot of trouble.

Track and Schedule Payments

Having your information in one place is convenient and Navient's payment reminder service and online profile allow you to stay on top of your responsibilities. You can track your recent payments and even request to change your due date to accommodate your payment schedule. Having all your loans in place comes in handy too during tax season. There is no shortage of benefits by having a Navient login and these are some of the most basic, but also the most useful features.

Deferment and Forbearance

Are you having trouble making payments on your student loans? Don't feel bad, it is common and Navient offers an excellent solution. Deferment and forbearance can be a great way to take the pressure off for a while. While interest will still accrue, a deferment allows you the opportunity to catch your breath for a moment and resume payments when you are ready. A Navient login can have you apply for this relief and the approval typically is swift.

Education after Education

Navient's website has a lot of valuable information such as education about different loans and a unique section called "Protecting Yourself From Fraud". This section aims to educate borrowers on the dangers of scams that promise to give debt relief or forgiveness. Keeping borrowers informed lets them know their options and allows them to plan better and make smarter choices about repayment.

Connections

Navient aims to help students, and that is why it partners with various educational institutions to keep students in the loop about what is going on with the state of education in the country. Navient also works closely with other financial institutions to protect their clients and increase loan prospects for students wishing to further their education. The web that Navient is a part of and the information it contains is all available with a Navient login. The more information you have about the process the better off you will be in the long run.

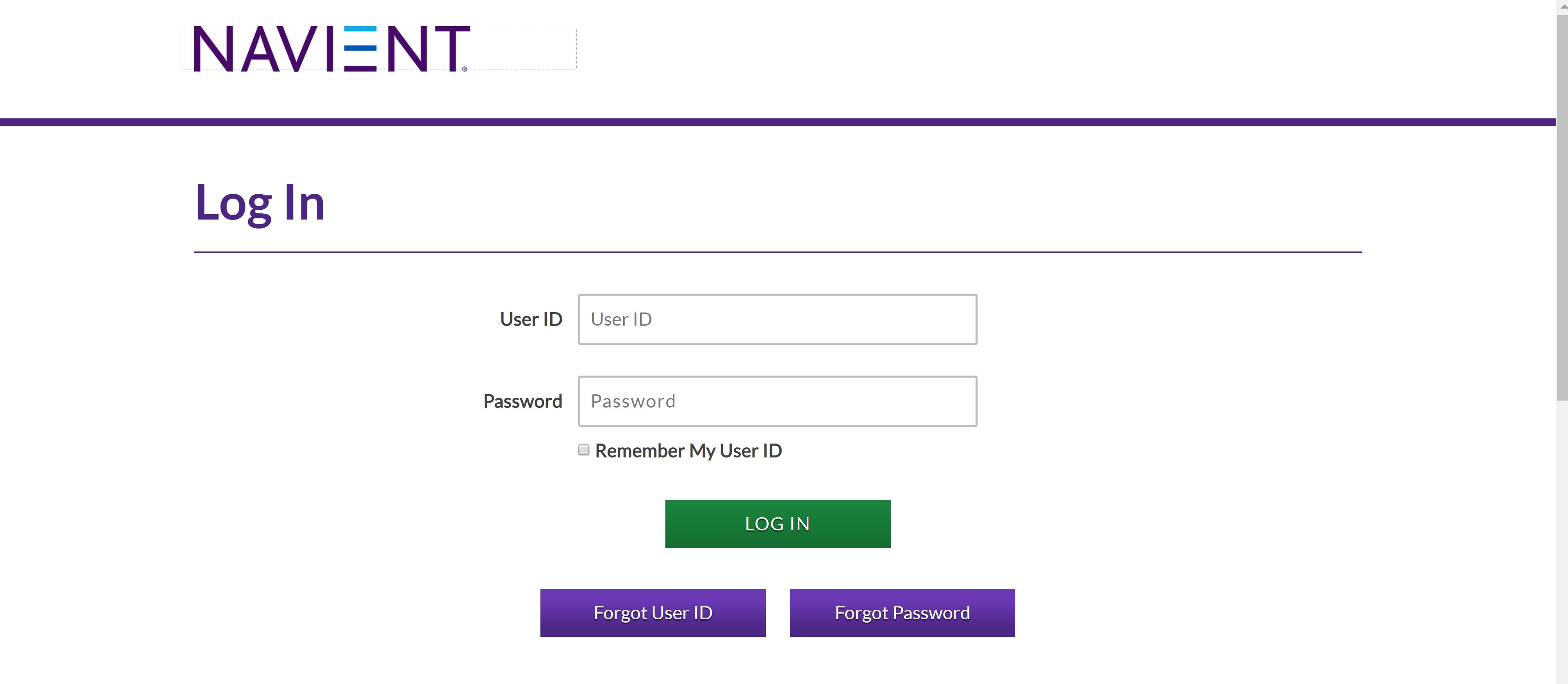

Navient Login

Now that you know all the advantages of having a Navient login there is no reason for you not to register and take advantage. We will show you how to set up your online account and how to keep up with your student loans on a recurring basis. Please remember that if you run into any trouble setting up your account, Navient has a toll-free line you can call for help: 1 (888) 272-5543.

Information

To register for your Navient login you will need either your Social Security Number or your Navient account number which should be located in your mailed Navient statements. Once you have this information, you can create a user ID and password. Your user ID must be between 6-62 characters and it is preferable that it is as unique as possible and easy to remember for you. Your password must be 8-32 characters and should include at least three of the following: lowercase letters, uppercase letters, special characters, and numbers. Once you have this information, you will have gained you Navient login.

Monthly Statements and Loans

On the home page, you will notice that your monthly statements are available as are your different loans. The Navient homepage lets you check in on all your commitments while also offering you all the services we mentioned above. Monthly statements are great and being able to archive them online is even better. Being able to check on your principal balance is good because you want to focus on it so you can repay your loan in the shortest time possible and avoid interest rates that will increase your overall balance.

Thinking Ahead

Navient attempts to ensure that students who are still in school and on their grace period still understand the importance of getting ahead on their loans. Educating students about quarterly interest rates can help them plan as they approach graduation. Taking initiative separates Navient from other loan servicers and it is why the U.S. Department of Education trusts them to handle federal loans on their behalf.

Conclusion

You are well aware now of how a Navient login can make your life a lot easier. Take full advantage of everything that Navient offers and make it work for you, for your future. Keeping yourself informed and organized will help you budget better. Keep up to date on changes to repayment options and eligibility, even for loan forgiveness and other programs that may kick in after a certain period of repayment. There is so much that you can do with a Navient login and it is all a click away.

Leave a Reply